Education

Your Good Credit

The Importance of Your Credit Report and Your Credit Score

- Maintain Good Credit

- Combat Identity Theft

- Free Credit Reports

Why you need to know about credit reports & credit scores

Having good credit and using it wisely are more important than ever these days. Fortunately, it is also easier than ever to monitor your credit files and to correct errors that could have a negative impact on your credit rating thanks to a series of federal laws designed to protect you, the consumer, in your use of credit, credit cards and the credit system.

For further information please Click Here.

Identity Theft

What To Know, What To Do

Here are important steps to take if someone has stolen your identity. Be sure to keep a record of all phone calls and correspondence.

- File a report with your local police department or the police where fraudulent use of your identity was made. Get a copy of the police report.

- Visit the Federal Trade Commission (FTC) website at www.consumer.ftc.gov/features/feature-0014-identity-theft.

- Report the theft to the FTC and get an identity theft affidavit at IdentityTheft.gov. File a copy of the identity theft affidavit and the police report with the three credit reporting agencies.

- Have the credit reporting agencies place a fraud alert on your files.

- Ask about placing a security freeze on your credit reports. This can help keep identity thieves from opening new accounts in your name.

- Get free weekly credit reports from the credit reporting agencies at AnnualCreditReport.com. Review them for fraudulent activity and other errors, and work with the agencies to get these corrected or removed.

- Promptly report fraudulent transactions to First Pioneer National Bank and your credit card companies.

- Send a registered letter to all creditors where fraudulent accounts have been opened and ask to have these closed. Include the police report and identity theft affidavit.

Avoid Fraud and Scams

- Talk over investments beforehand with relatives, friends or a financial advisor.

- Don’t be pressured into making quick decisions. Research offers thoroughly.

- Never pay in advance to claim a prize, lottery, credit cards or other offer.

- Don’t give your debit or credit card numbers, checking account or Social Security number to unknown callers.

- Don’t share personal information online unless you are buying from a company you know and trust.

- Don’t open the door for people you aren’t expecting.

- Check out anyone claiming to be a relative in crisis before sending money.

- Compare prices and companies before agreeing to home repairs or improvements. Get all details in writing.

- Research charities before making donations.

Check Fraud / Counterfeit Checks

Check fraud is one of the largest challenges facing businesses and financial institutions today. Affordable software and hardware and other advancements in computer technology are making it easier to duplicate checks or fabricate new ones. A significant amount of check fraud is due to counterfeiting through desktop publishing software, color copiers, and high-quality printers. In addition, chemical alteration is used whereby the criminal removes some or all of the information and manipulates it to their benefit.

Below are some signs which may indicate a bad check, particularly where multiple signs are present:

- A check printed on poor quality paper that feels slippery.

- Check colors that smear when rubbed with a moist finger (This suggests they were prepared on a color copier).

- A personal check that has no perforated edge.

- A check on which information shows indications of having been altered, eradicated, or erased.

- A check drawn on a new account that has no (or a low) sequence check number or a high dollar amount.

- A check on which the name and address of the drawee financial institution is typed, rather than printed, or that includes spelling errors.

- The customer's name and address is missing.

- Numerical and written amount do not match.

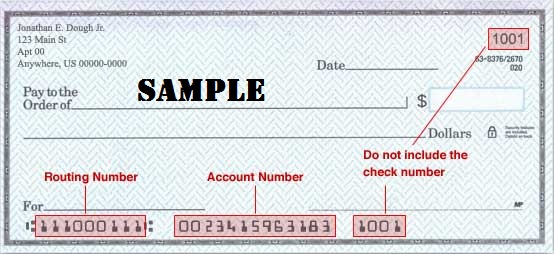

- The MICR numbers are missing. (NOTE: Magnetic Ink Character Recognition or MICR refers to the number at the bottom left-hand corner of a check, printed in magnetic ink that can be read by machines. The numbers usually are encoded with the routing number of the financial institution, the account number, and the check number. The nine-digit number between the colon brackets on the bottom of a check is the routing number of the bank on which the check is drawn. The first 2 digits indicate in which of the 12 Federal Reserve Districts the bank is located. It is important that these digits be compared to the location of the bank because a forger will sometimes change the routing number on the check to an incorrect Federal Reserve Bank to buy more time.)

- The MICR encoding at the bottom of the check does not match the check number.

- The MICR coding does not match the bank district and the routing symbol in the upper right-hand corner of the check.

- The word "VOID" or "non-negotiable" appears across the check.

- The check lacks an authorized signature.

- A signature that is irregular-looking or shows gaps in odd spots.

- Corporate or government checks which show numbers that do not match in print style or otherwise suggest that the amount may have been increased.

- Checks presented at busy times by belligerent or distracting customers who try to bypass procedures.

Helpful Websites

- Identity Theft Consumer Information

- Identity Theft Recovery Steps

- FDIC – Consumer Protection

- Better Business Bureau Scam Alerts

- Free Annual Credit Reports

Credit Reporting Agencies

- EQUIFAX 800-525-6285

- EXPERIAN 888-397-3742

- TRANSUNION 800-680-7289